Loan Fees

This post is subject to change and will be updated as needed. Any change to our fee structure will be accompanied by an announcement in our Discord

Listing Fee

Each time a Borrower adds a new loan listing to the Flowty Marketplace, a fee of $1 will be assessed. As of now, users cannot edit listings, though we are currently evaluating an edit feature.

NOTE: the listing fee has been waived until further notice

Transaction Fee

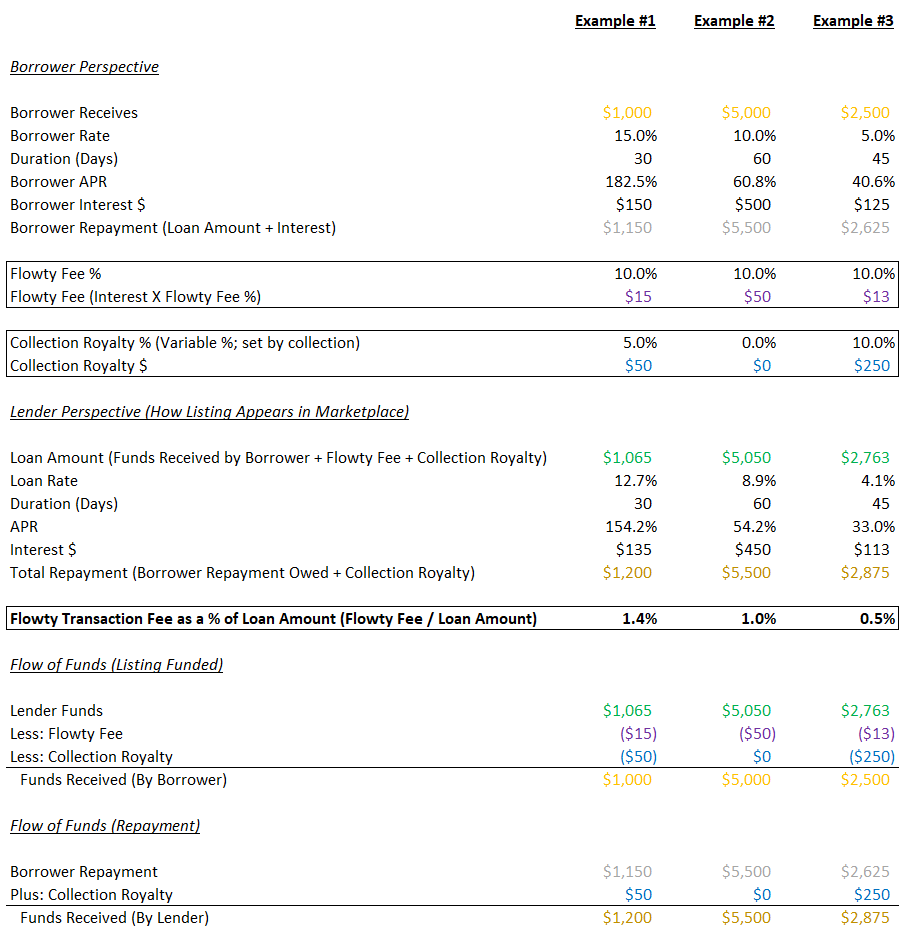

When a Lender funds a listing, a transaction fee will be assessed. The transaction fee will be calculated as a percentage (10%) of the Borrower’s interest on a loan and will be assessed at the time of funding.

In most loans, the Transaction Fee is about 1% of the loan amount. See below examples.

Collection Royalty Assessed on Default (Not a Flowty Fee)

The following outlines the royalty process:

When a loan is funded by a Lender, any applicable collection royalty (royalty percentage is set by the creator) is collected and set aside in a smart contract (not in Flowty’s custody)

If a loan is repaid by the Borrower (no transfer of ownership of underlying collateral), the royalty is returned to Lender

If a Borrower defaults (ownership of collateral is transferred to Lender), the royalty is sent directly to the creator of the collection

At no point does Flowty have custody or control of the royalty

Flowty does not profit in any way from the royalty

The following examples may be helpful:

Notes:

Collection royalty is collected as part of the initial loan funding and is returned in full to Lenders if a loan is repaid by a Borrower (no transfer of ownership)

Flowty never takes custody of collection royalties — they are either returned to Lenders (repayment scenario) or sent directly to creators (default scenario)

APR is calculated as (365/Duration * Rate)

If a Borrower defaults (does not repay), the Lender receives the underlying collateral in lieu of a repayment

The Borrower receives the loan amount as seen in the Marketplace net of Flowty’s transaction fee and collection royalty

Marketplace listings are presented from the Lender’s perspective (Borrower sees different metrics when adding a new listing to the Marketplace; see table above for detail)

The Borrower’s loan rate paid is higher than the loan rate in the Marketplace (the loan rate received by Lenders) because the Borrower receives funds net of the flowty transaction fee and collection royalty

The transaction fee is assessed at the time a listing is funded and is not contingent on a Borrower repaying (rather than defaulting on) a loan

Questions?

Please feel free to contact us via Discord with any questions regarding the calculation of rental fees

Last updated