How to Value and Price Loan Listings on Flowty

Original post (January 31, 2022); Edited (to reflect some minor updates) on May 19, 2022 as part of transition to Gitbook

Introduction

If you are new to flowty, please take a moment to review our step-by-step guide and overview of the platform — Flowty Primer. It is important to us that all of our users are comfortable and familiar with flowty’s functionality before taking any actions on the platform.

Flowty’s peer-to-peer collateralized NFT lending marketplace matches Borrowers (NFT owners seeking access to short-term liquidity) with Lenders (knowledgeable ecosystem participants seeking to generate a return on capital with the downside protection of securing an NFT).

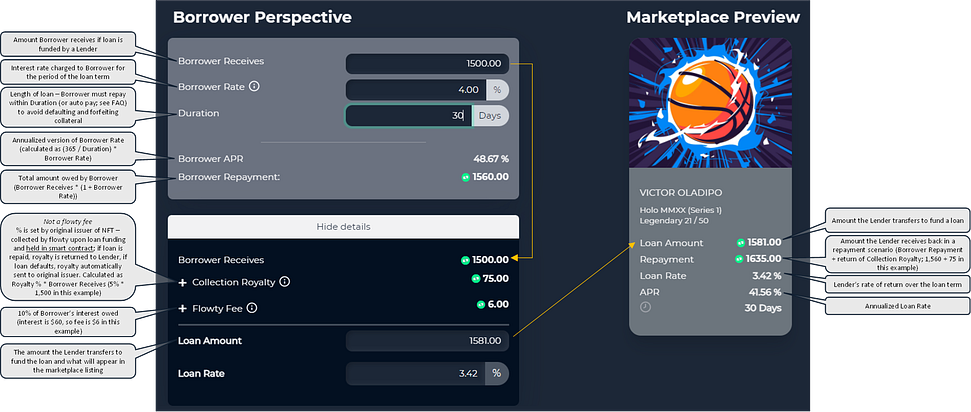

The platform allows Borrowers to dictate the terms at which they would like to borrow. Borrowers will be presented with the following listing modal:

While some Borrowers may feel comfortable setting terms, others may benefit from reviewing some data and information from existing markets before making decisions. This post is designed to help Borrowers make informed decisions on how to size (loan amount) and price (loan rate) their listing over what time frame (duration).

The Market Rules

Please note that Lenders will be the ultimate decider of which listings are sufficiently attractive to be funded. Borrowers can use the information provided herein to help determine terms, but there is no guarantee that a Lender will accept those terms.

Over time, we expect market standards to develop and both Borrowers and Lenders to have a better sense of what terms are more likely to be accepted by the market. Once we have a reasonable database of historical loans, we will provide our users with statistics and metrics that offer insight into the market’s preferences.

We would like to stress that flowty will not provide specific guidance or recommendations regarding your loan listing. We will provide general or collection-specific information and data, but the collective user base (both Borrowers and Lenders) will determine how the market evolves.

Some General Thoughts on Loan Terms

Like many other financial decisions, determining the appropriate terms for a flowty loan listing can be viewed as a risk-reward analysis. In our case, the risk is the likelihood that the underlying collateral falls in value during the loan term, and the reward for the Lender is either interest generated or the underlying collateral itself. Deciding how to size and price a listing involves assessing risk and setting the terms of a listing to adequately compensate a potential Lender for the risk he or she is taking.

Multiple factors, which we will expand upon below, can be considered when trying to quantify or measure the risk of a loan: the value of the underlying collateral, size of the loan relative to the value of the collateral (known as the Loan to Value (LTV) ratio), volatility of the underlying asset, maturity of the collateral’s market, state of the overall NFT market, duration of the loan (longer loans are riskier for Lenders), and more. In general, a riskier listing would be more likely to be funded by a Lender if the reward (the interest rate) accounts for the level of risk.

The NFT market is in its infancy. The market is volatile, especially for new collections, and collectors lack an extensive transaction history to draw upon for insights into how market conditions may evolve. The early stages of a platform like flowty will likely include a phase of price discovery in the market until precedents and norms are established.

There are three inputs (Loan Amount, Loan Rate, and Duration) required to add a listing to flowty’s Marketplace. We will review each of the three below.

“Loan Amount”

Due to fees and royalties, the amount a Borrower receives differs from the amount a Lender funds. For the purposes of this post, “Loan Amount” will be defined as the amount that the Borrower will receive on a loan (net of fees and royalties).

In most lending markets, the Loan Amount is viewed as a percentage of the value of underlying collateral. This percentage or ratio, as we mentioned earlier in the post, is known as the Loan-to-Value (LTV). The size of the loan divided by the value of the underlying asset is a loan’s LTV. One useful aspect of LTV is that it can be used as a quick way to quantify how much the collateral’s value can fall before reaching the Loan Amount. In general, we would expect listings with riskier collateral to be funded more frequently if they have a lower LTV to help Lenders justify the higher risk of the underlying collateral.

Example:

Borrower has an NFT that he believes is worth $100. Borrower would like to borrow $40. The LTV (using the Borrower’s view of the value of the collateral) of this loan would be 40% ($40 / $100). A simple way to think about a 40% LTV is that if the value of the underlying collateral falls by less than 60% (100% minus LTV of 40%), ignoring fees and royalties, the Lender will likely be able to recover most or all of his capital in a default scenario. There are other considerations (interest accrual, illiquidity of market for underlying collateral, etc), but this is a simple technique to quantify the amount of cushion that a Lender has on his loan. Loans on safer assets (like real estate) often have higher LTVs (as high as 75–90%). Volatile or risky assets, such as NFTs, may require lower LTV loans to balance a Lender’s risk.

Flowty is, in many ways, similar to a peer-to-peer pawn shop, so we thought it might be helpful to provide some data around typical pawn shop LTVs. Like flowty, pawn shops specialize in short-term loans, typically 30–60 days. LTVs on pawn shop loans typically range from 25–50% (source), depending on the asset. Similar to a flowty Lender, pawn shops accept the risk that an asset falls in value (to a level below the loan amount) and the borrower defaults, leading to a loss for the shop.

For help determining a fair and reasonable value for your collateral, we have integrated a MomentRanks-powered LTV on our platform. Read more about the “MR LTV” here.

We also encourage you use one of several analytical platforms around the Top Shot ecosystem for information on historical sales, valuation estimates, trends, and more. Some of our favorites: MomentRanks, Own the Moment (OTM), Evaluate Market, and LiveToken. Please note that the preceding are third-party, independent platforms and flowty cannot guarantee the accuracy of the information and analytics.

Duration

Duration is the length of a loan from the time a Lender funds a loan to the loan’s maturity. Another way to think of Duration is that it is the maximum amount of time that a Borrower can take to repay the loan before defaulting (assuming the Borrower has not opted in for auto repayment — see FAQ). At the time of repayment, the Borrower must pay the total amount of the loan plus interest to reclaim the collateral. A Borrower may benefit from selecting a Duration that factors in when he or she would have the ability to repay. That may be tied to an investment, upcoming paycheck, or event.

When determining Duration, we recommend that you keep in mind that the longer the loan lasts, the greater the risk for the Lender. A longer time horizon increases the likelihood that a project or the NFT market at large experiences a material change, positive or negative. From the Lender’s perspective, upside is capped by the interest rate, so the Lender does not benefit from a material positive change in the value of the underlying asset, but may experience a loss if the underlying collateral sees a material negative change in value.

This type of one-sided risk is exacerbated the longer a loan is outstanding. As such, longer Duration loans may be funded with greater frequency if the interest rate takes into account the length of the loan.

Interest Rate

Interest can be thought of as a Lender’s compensation or fee for accepting the risk of a Borrower’s loan. The interest rate is the metric used to determine the amount of interest that a Lender would receive if a Borrower repays a loan. Conventionally, the interest rate accounts for all the risk factors inherent in a loan, from LTV to underlying market conditions of the collateral to the length (Duration) of a loan. Higher interest rates help justify greater risk for a Lender.

Given the volatility and uncertainty inherent in NFT markets, Lenders may expect higher interest rates on flowty loans than one might see for other types of loans (house mortgage, credit card loan, margin on stocks, personal loan, art, antiques, other collectibles, etc).

The interest rate can also be thought of as the “variable” category that allows a Borrower to define a specific Loan Amount and Duration, both of which may be inflexible based on a Borrower’s circumstances. Increasing a listing’s interest rate may make the listing sufficiently attractive for a Lender to fund.

Comparing to Other Collectible Markets

Because NFTs are such a new asset class, it may be helpful to consider existing and familiar markets for assistance with pricing. As the flowty ecosystem grows and matures, this will be less applicable, but in the absence of historical data, it is often productive to look at comparable markets.

Sports Cards

The sports card industry is an alternative asset class that utilizes collateralized loans. PWCC, a sports card consignment company, offers loans using graded sports cards as collateral. Their LTV ranges from 1–40% and PWCC only offers short-term loans, with the option to renew at the end of the term. They typically charge 1% monthly interest. In addition to the interest rate, PWCC charges consignment fees (required to request a loan) that can range as high as 20%, so the effective interest rate can be significantly higher. (source)

Art

There are a number of factors that are considered in the art-lending market. Most loans are issued by banks that require account minimums and other criteria that would impact the terms of a loan (source). There are also non-bank lenders in the space. The consistent thread from our research is that lenders typically lend up to 50% of appraised value (50% LTV). The interest rate varies based on the underlying asset and the lender’s relationship with a borrower.

Pawn Shops

Given the variety of NFTs that will be supported on flowty, pawn shops may offer useful benchmarks. Pawn shops typically lend between 25–50% LTV and offer 5–25% interest rates on loans (source).

Conclusion

Although loans that rely on collectibles or art are relatively common, loans using NFTs as collateral do not have an extensive track record. The NFT market is new, volatile, and continuously evolving, which introduces unique challenges for Borrowers trying to determine reasonable inputs for loan listings.

In flowty’s earliest stages, before much data is available, it may be helpful to use information from other lending markets for guidance on how to price loans. Over time, as the platform matures and flowty’s transaction history grows, Borrowers and Lenders will have better information to leverage while setting loan terms.

If you have a loan listed and a Lender has not yet funded the loan, you may want to consider relisting with one or more of the following to increase the attractiveness of the listing to Lender:

Lower LTV

Higher interest rate

Shorter duration

Where to Find Us

Product Docs (FAQ, Step-by-Step Guides, etc)

Last updated